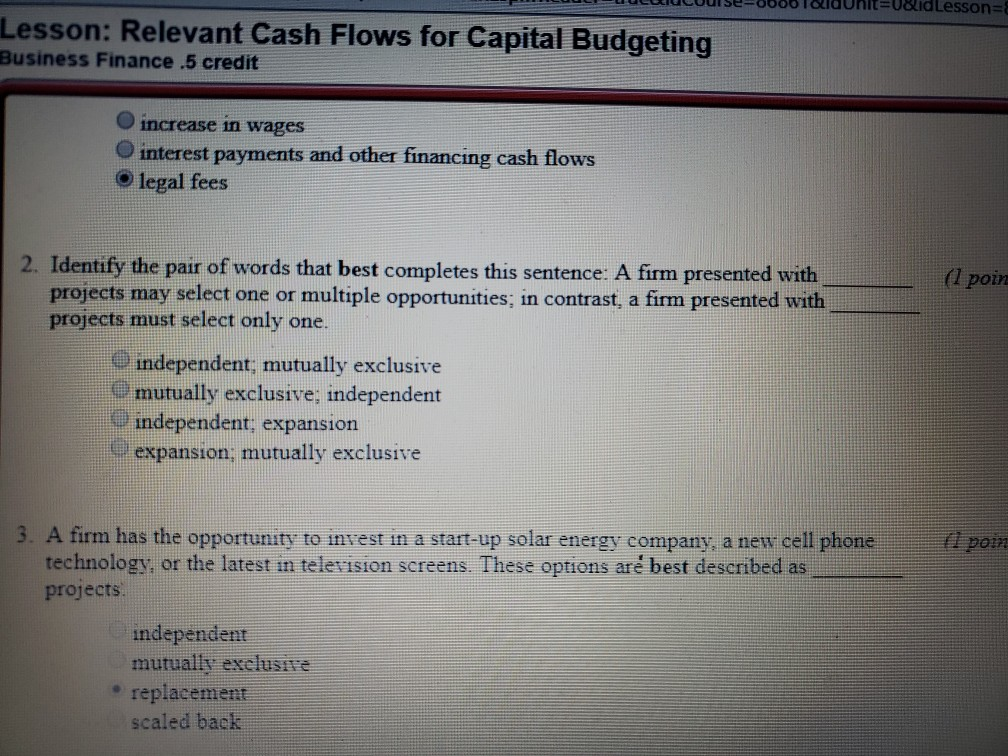

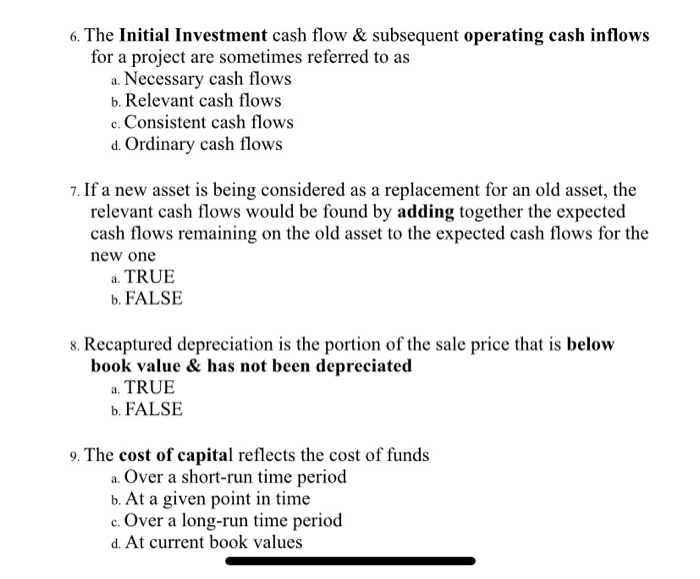

The Relevant Cash Flows Of A Project Are Best Described As:

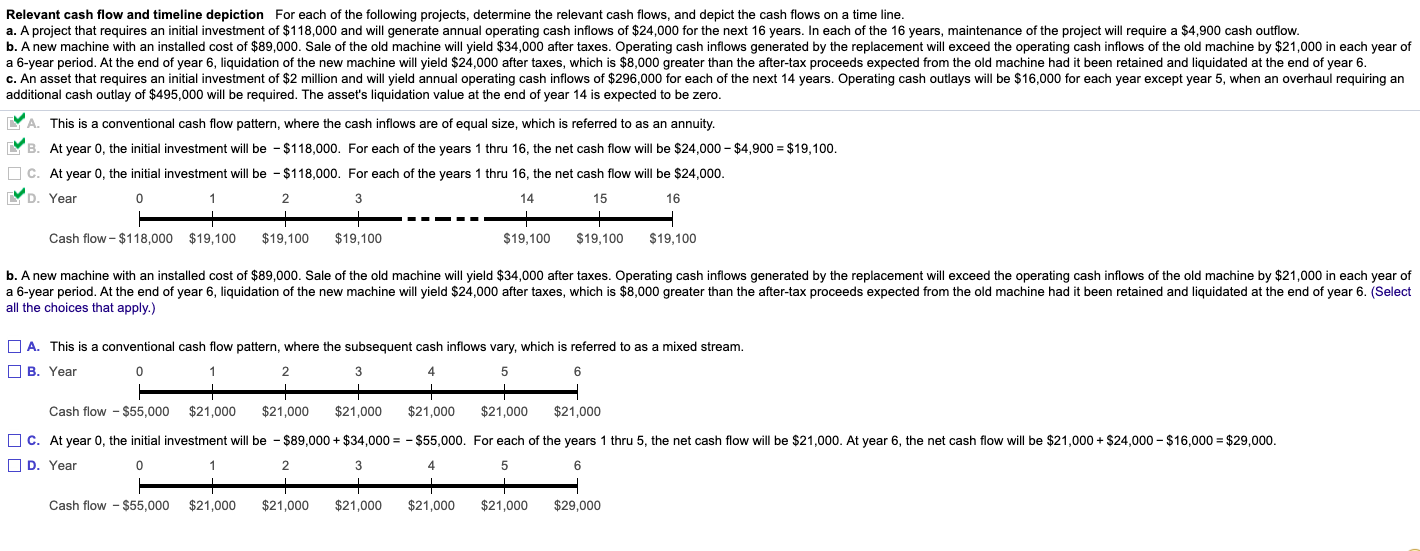

The relevant cash flows of a project are best described as:. On a relevant cash flow basis we do not need to be concerned with what has been paid in the past so the 1000 per year paid in the past is a sunk cost and can be ignored from relevant cash flows. Normal cash flow item. D incidental cash flows.

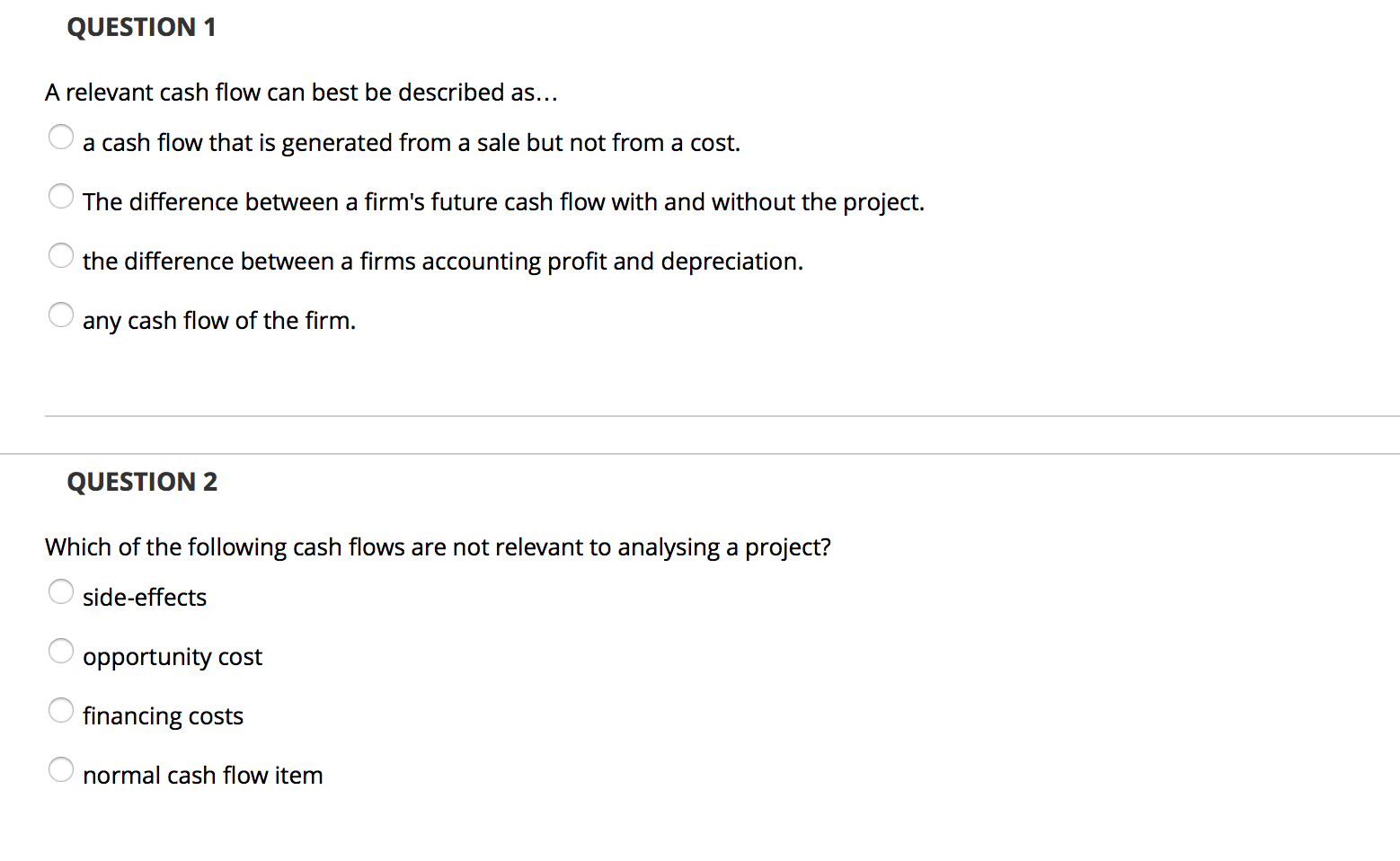

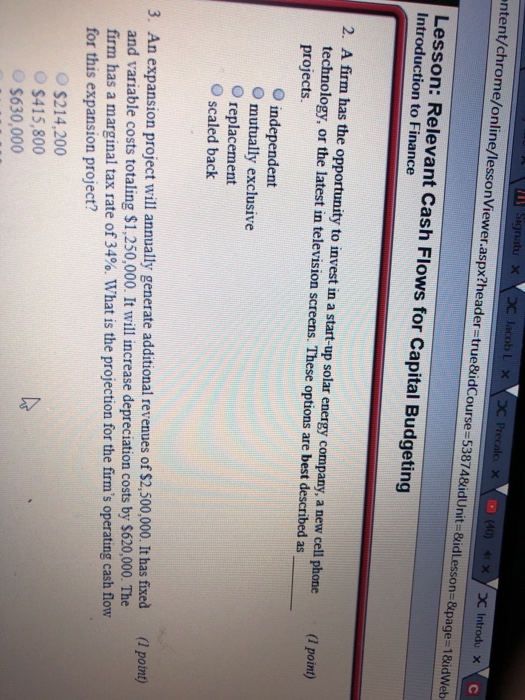

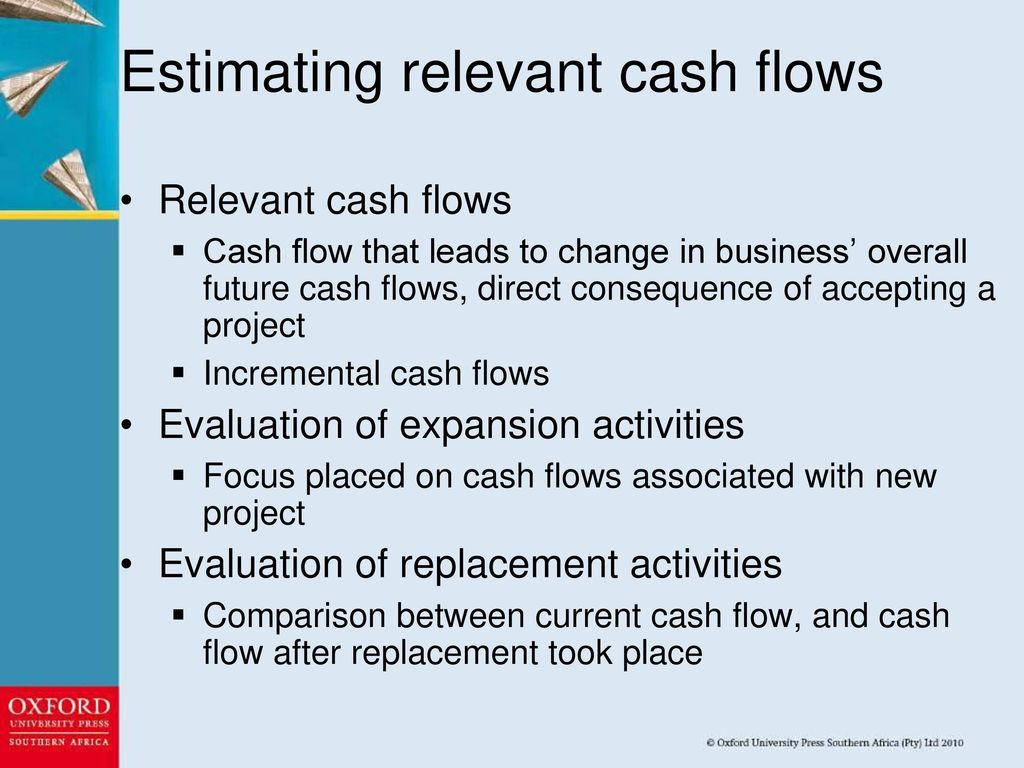

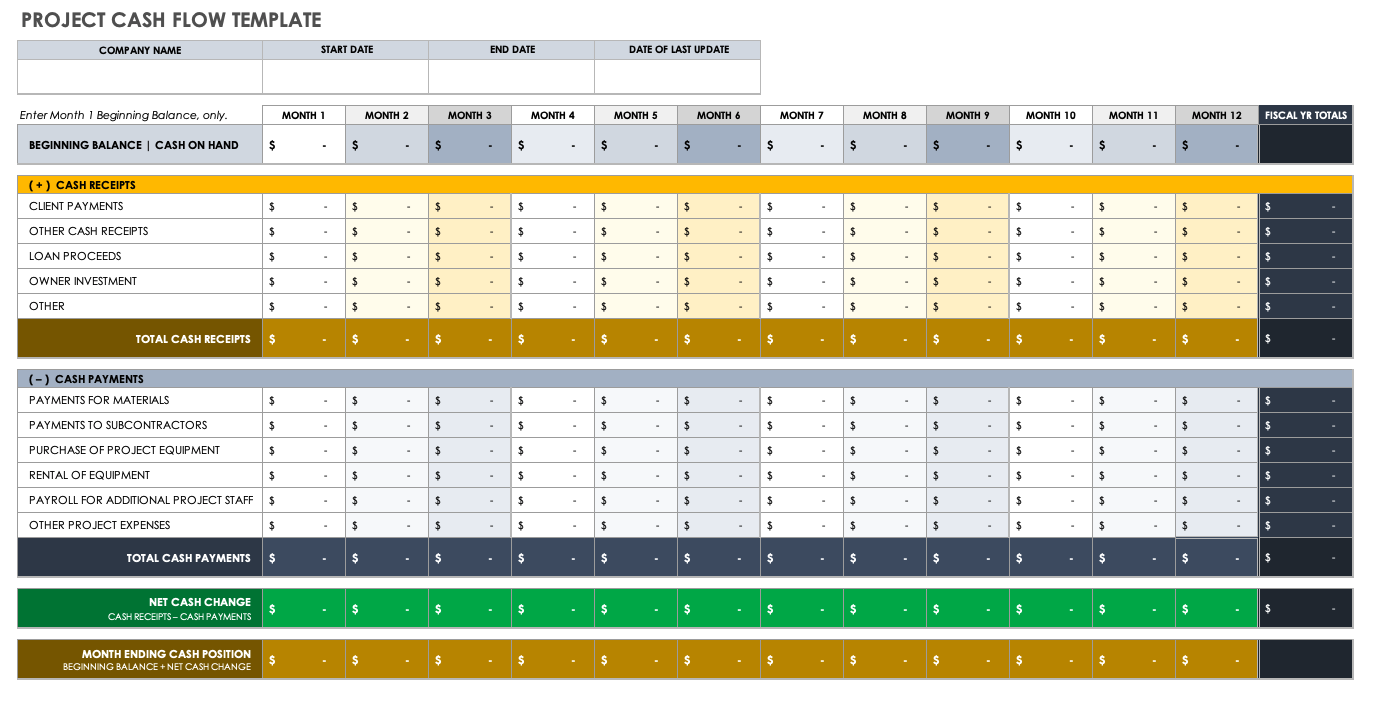

The relevant cash flows of a capital budgeting project are. The difference between a firms future cash flow with and without the project. Project cash flow includes revenue and costs for such a project.

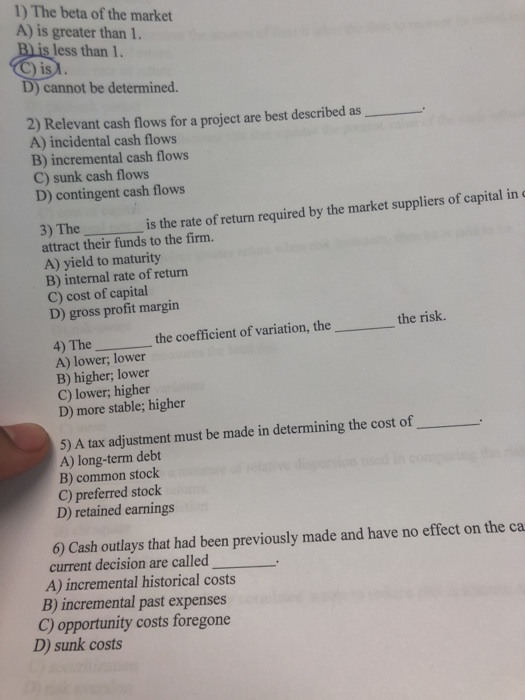

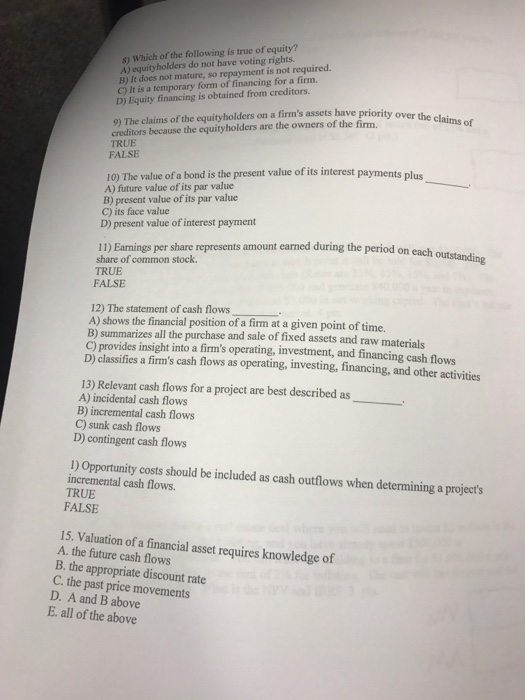

Sanjaykumarkuma2726 19062018 Business Studies Secondary School 13 pts. B sunk cash flows. 1 The Beta Of The Market A Is Greater Than 1.

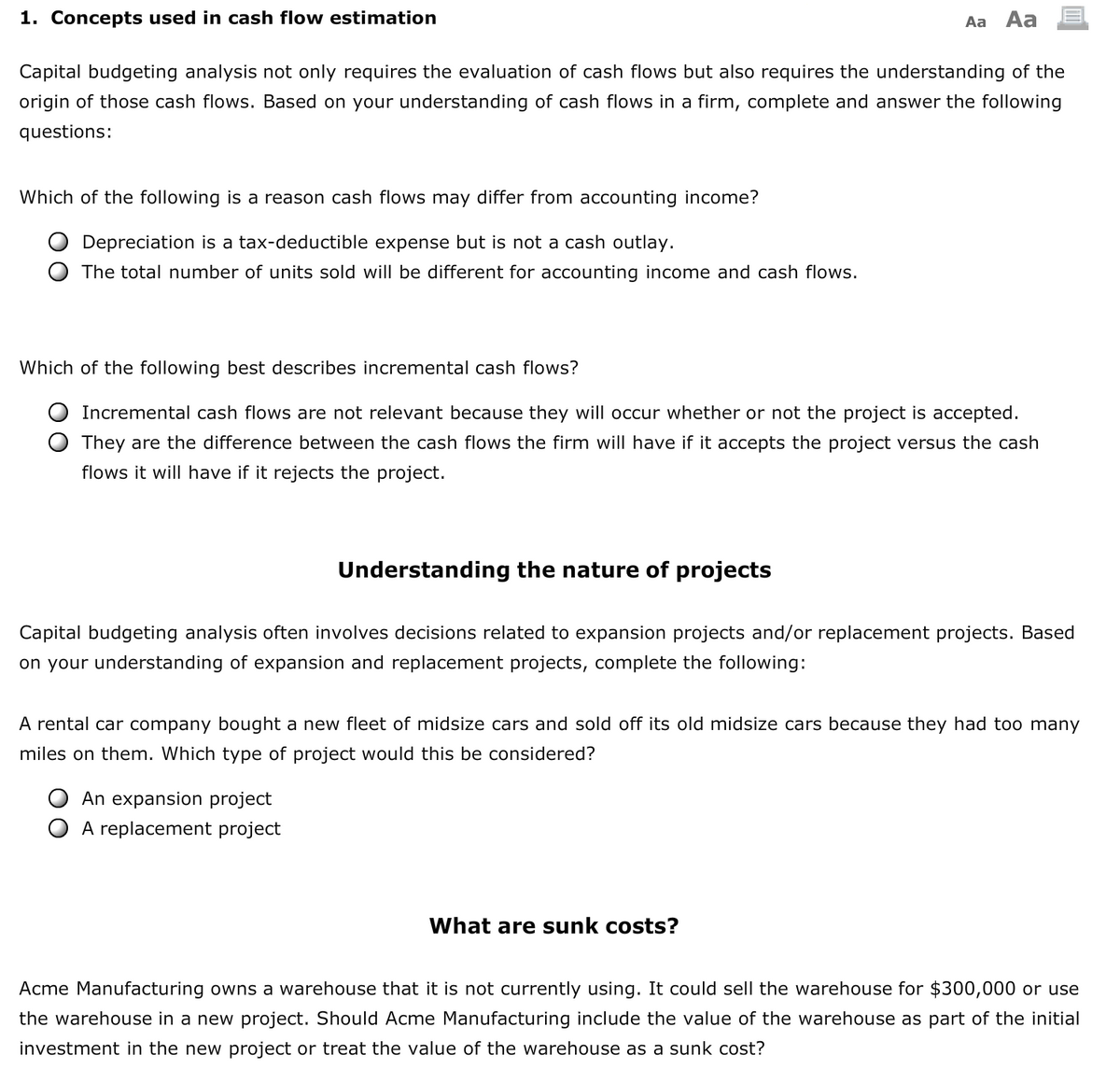

The total cash flows of the company. A relevant cash flow can best be described as a. Incremental cash flow is the additional operating cash flow that an organization receives from taking on a new project.

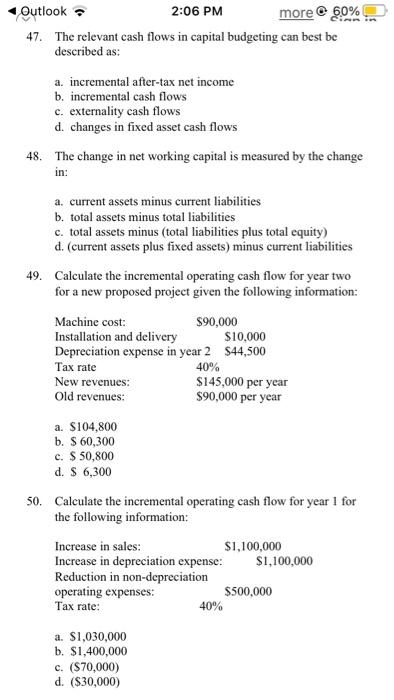

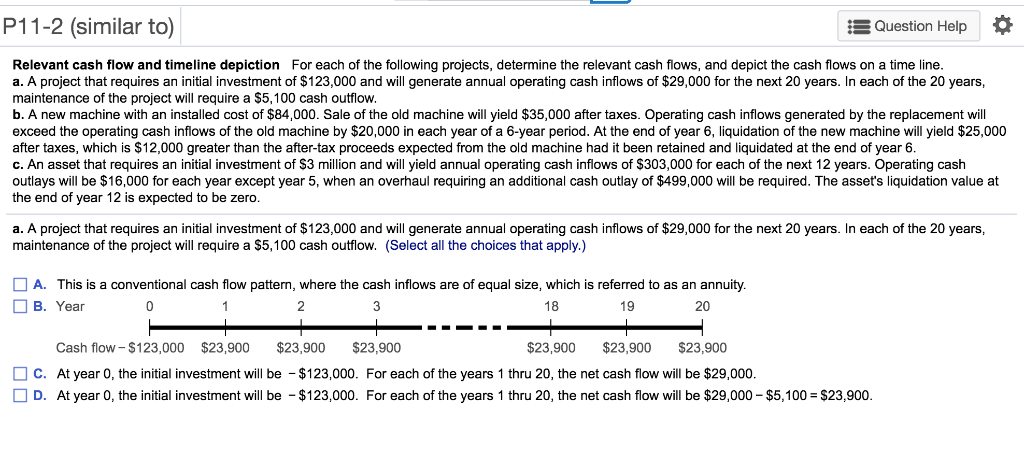

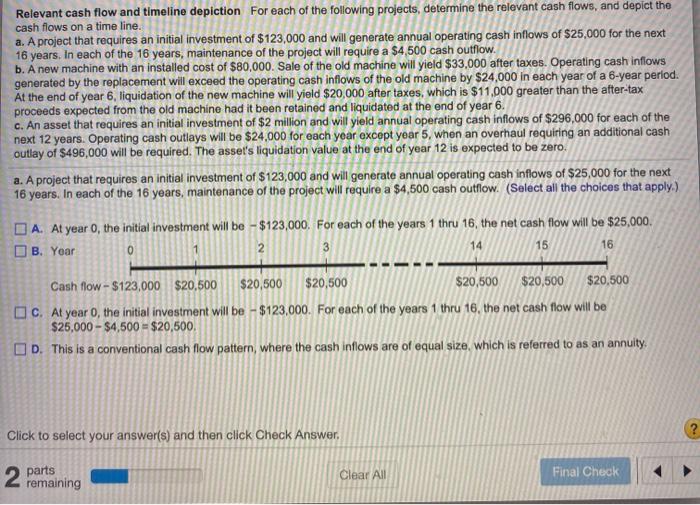

Incremental cash flows are changes in cash flows that occur because a company decided to proceed with an investment. A incidental cash flows B incremental cash flows C sunk cash flows D contingent cash flows. The incremental added outflows which occur if we proceed with the project.

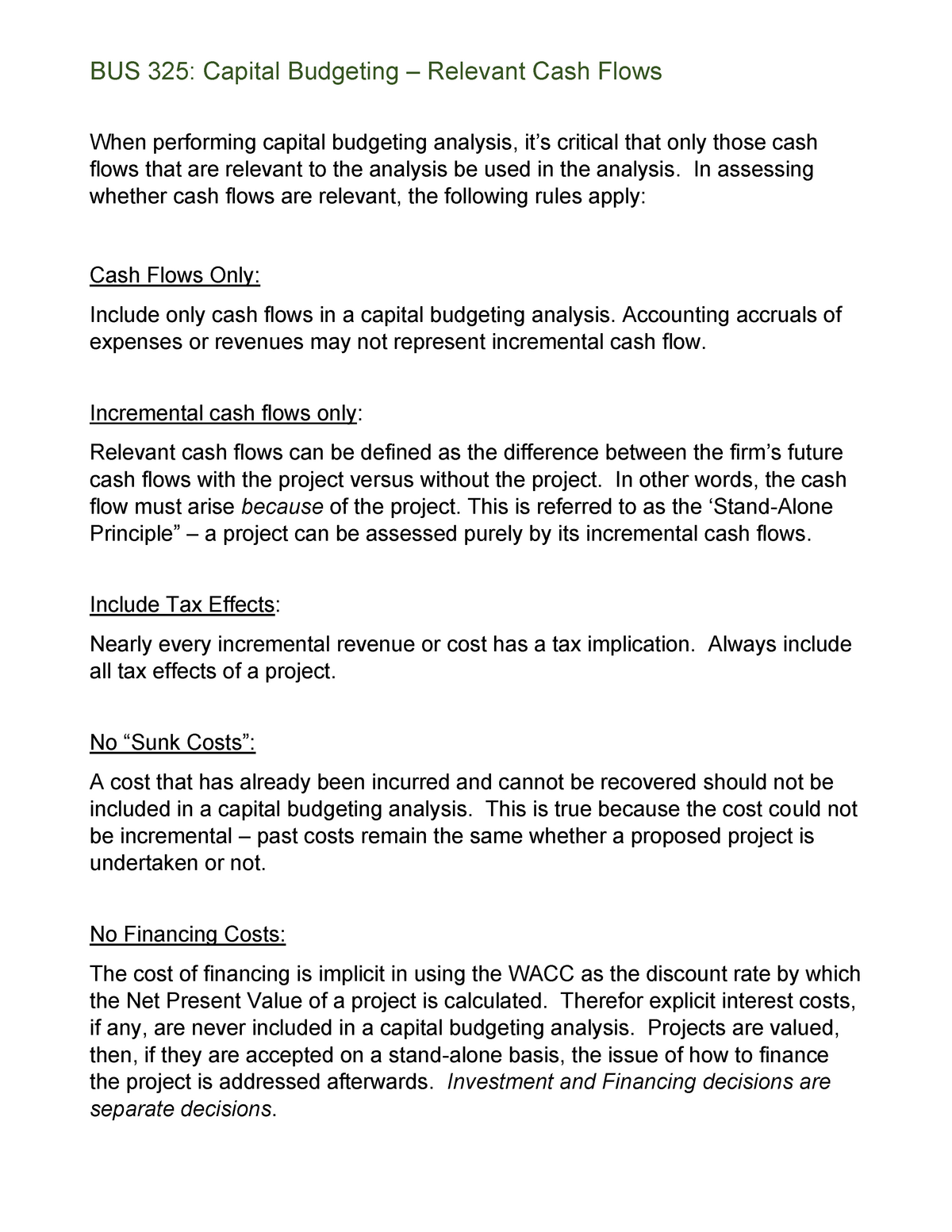

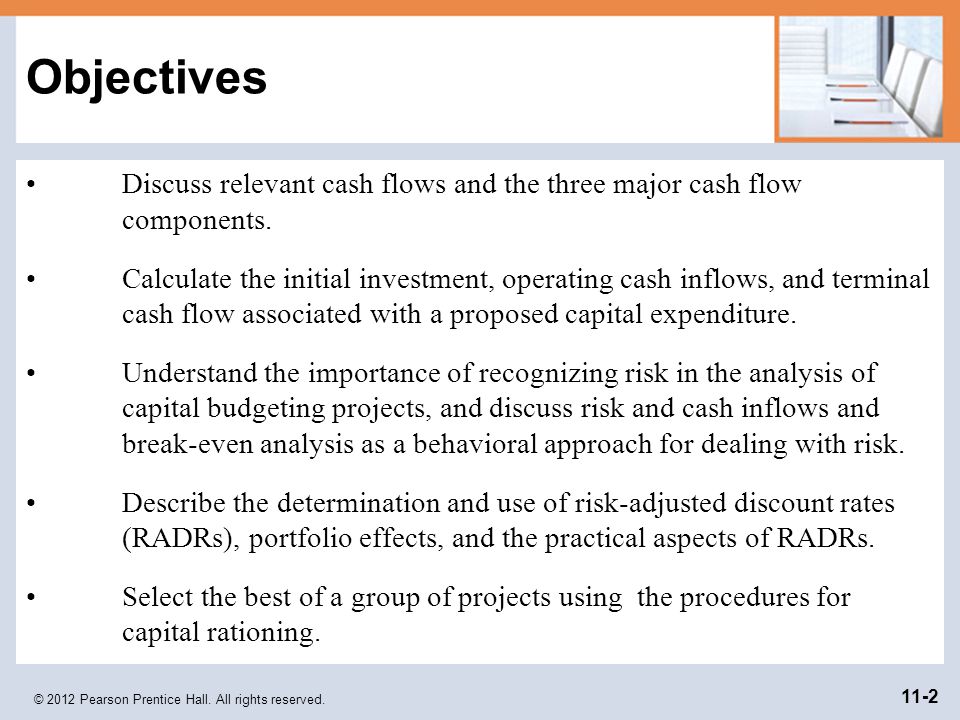

Which of the following cash flows are not relevant to analyzing a project. C incidental cash flows. Click here to get an answer to your question Relevant cash flows for a project are best described as 1.

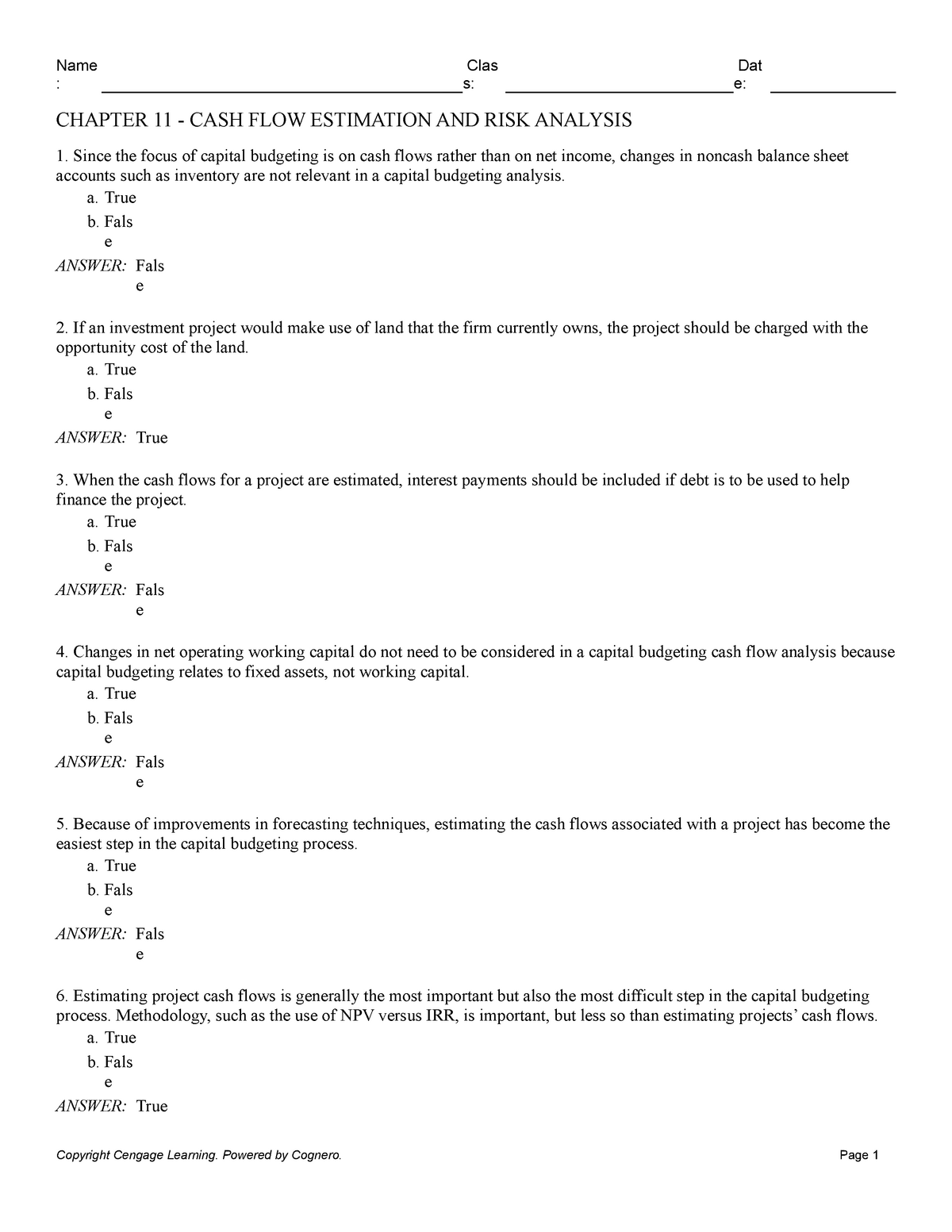

It is also important that candidates can identify relevant cash flows in order to be able to use them in the. When making replacement decisions the development of relevant cash flows is complicated.

The general principle is simple enough.

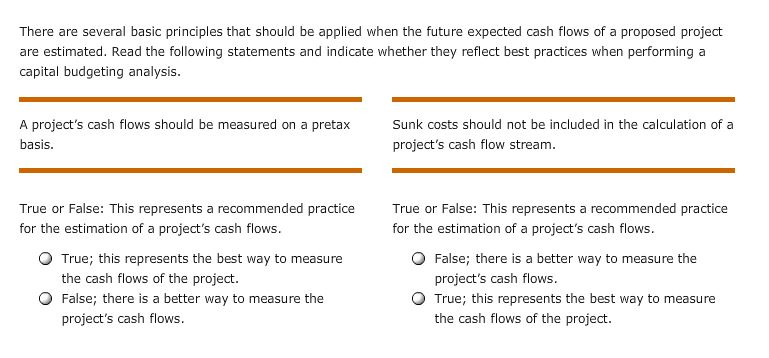

The Paper FFM Study Guide references E3 c and E3 d require candidates to be able to both discuss the concept of relevant cash flows and identifyevaluate relevant cash flows. On a relevant cash flow basis we do not need to be concerned with what has been paid in the past so the 1000 per year paid in the past is a sunk cost and can be ignored from relevant cash flows. A cash flow that is generated from a sale but not from a cost. Project cash flow refers to how cash flows in and out of an organization in regard to a specific existing or potential project. What about the 1000 per year in the future if Mrs Clip continues with the. Sunk costs have no effect on the cash flows relevant to the current decision. The total cash flows of the company. Incremental cash flow is the additional operating cash flow that an organization receives from taking on a new project. 1 The Beta Of The Market A Is Greater Than 1.

Because the relevant cash flows are defined in terms of changes in or increments to the firms existing cash flow they are called the incremental cash flows associated with the project. The incremental added outflows which occur if we proceed with the project. When evaluating a capital budgeting project installation costs of a new machine must be considered part of. Which of the following cash flows are not relevant to analyzing a project. What about the 1000 per year in the future if Mrs Clip continues with the. Any cash flow of the firm. It is also important that candidates can identify relevant cash flows in order to be able to use them in the.

/dotdash_Final_What_Changes_in_Working_Capital_Impact_Cash_Flow_Sep_2020-01-13de858aa25b4c5389427b3f49bef9bc.jpg)

/dotdash_Final_Corporate_Cash_Flow_Understanding_the_Essentials_Oct_2020-01-3c5fb3c82fb240c0bad19e14f04ce874.jpg)

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)

/DiscountedCashFlowsvs.Comparables2-fea4624dffab4bd8bec311cb6d134a2f.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Formula_to_Calculate_Net_Present_Value_NPV_in_Excel_Sep_2020-01-1b6951a2fce7442ebb91556e67e8daab.jpg)

/AppleCFJune2019-7034d23092e14723b39c1c22f5e170b3.jpg)

Post a Comment for "The Relevant Cash Flows Of A Project Are Best Described As:"